Here is another interview with our area managers. In this post we haveput some questions to Roberto Tomasoni who oversees the French, Belgian and Dutch markets.

A short presentation of Roberto Tomasoni…

I am the Area manager who oversees the French, Belgian and Dutch markets. I am 59 years old and I think that makes me the oldest salesmanager of the company. I started working in this sector in November 1988 in Zuani, where I followed several foreign markets. In 1997 I abandoned this business for a while to work in the marble and granite sector. In 2000 I was back in Zuani and I have never left since then. Following the merge, I now work in TWT. All told, I have been working in the wooden windows segment in foreign markets for more than thirty years.

Which are the main features of these markets?

Each one of these markets has its own window model of reference. The Netherlands, for example, over the years have chosen a particular type of window that is sold only in the Flemish area of Belgium and nowhere else. The Dutch are very fond of this type of window and, in this respect, could be defined as ‘conservatives’.

Belgium too has a favourite window, all wooden, sometimes not even painted because only hardwoods are used. The sector in Belgium is quite ‘conservative’ too. I remember it took us a long time to pass from the 58 mm standard to the 68 mm variant and, still today, certain businesses equipped with large plants ask to have a group dedicated to the 58 mm window. Despite this, in the sector it is important to propose potential variants because, even before spring of 2020, the market started to show a desire for innovation and for better thermal performance.

Those who sought and proposed new technological solutions have succeeded in acquiring new orders and better prospects for the future. The wooden window market has become a niche market. If you have the usual product and you are competing with other manufacturers who have a window that is practically the same as yours, you don’t stand out in the clients’ eyes or, adversely, the main distinguishing element becomes the price.

A price war always turns into a ‘bloodbath’…

This is in part the characteristic of the current Belgian and Dutch markets, and with our solutions we want to go against the trend.We are interested in bringing the dialectics of the market onto contents based on the product’s performance and on quality.

What about the French market?

France too has its ‘typical’ windows. One of them is the historic and traditional à l’Ancienne window that is installed mostly in historic town centres and partly in northern and southern France. It is a very simple window that does not offer special thermal transmittance and noise abatement performance. Another typical type is the Recouvrement window (image on the left) that is the most common and in some aspects is similar to the Belgian one.

In France, however, the window sector is distributed as follows: 70% PVC windows, 20% aluminium windows, 7% wooden windows, and the remaining 3% divided between wood-aluminium windows and wood-PVC windows. In France also there are companies interested in new products, despite the fact that those who buy new production lines tend to keep the à l’Ancienne window among its main proposals. This is especially true for the Parisian market, within the first arrondissements, namely downtown.There are many companies, especially from Brittany and Normandy, that work in Parisian construction sites installing this window model alone.

We are once again in the presence of a traditional product: is there competition?

Yes, and we can consider it an opportunity!In fact, all three of these countries (France, The Netherlands, Belgium) suffer the competition with the PVC window and passively undergo the production force of Poland that places on their markets the traditional models of wooden windows.

In this context, we position ourselves as the element of change and distinction, and we generate new stimuli for wooden window installers. In 2021 we are proposing new solutions with modern design that knock down production costs while maintaining the peerless quality, performance and essence of wooden windows.

In addition to competition, are there other critical aspects?

Yes, there are other aspects that would appear to advise against investing in this sector. Once again, we welcome the opportunity! First of all, the market is a niche one and, in recent years, it has shrunk considerably in terms of manufacturers. Our proposal increases performance and quality to enhance the companies that invest in the timber sector and, consequently, to ensure a top quality finished product.

Our solutions allow to work with agility and precision and favour fast and accurate artefact production and assembly.The opportunity is to maintain or elevate the quality of the product while significantly lowering overall costs and generating more sales, also to the advantage of smaller companies.

Among those seeking new products, which TWT system is sparking the most interest?

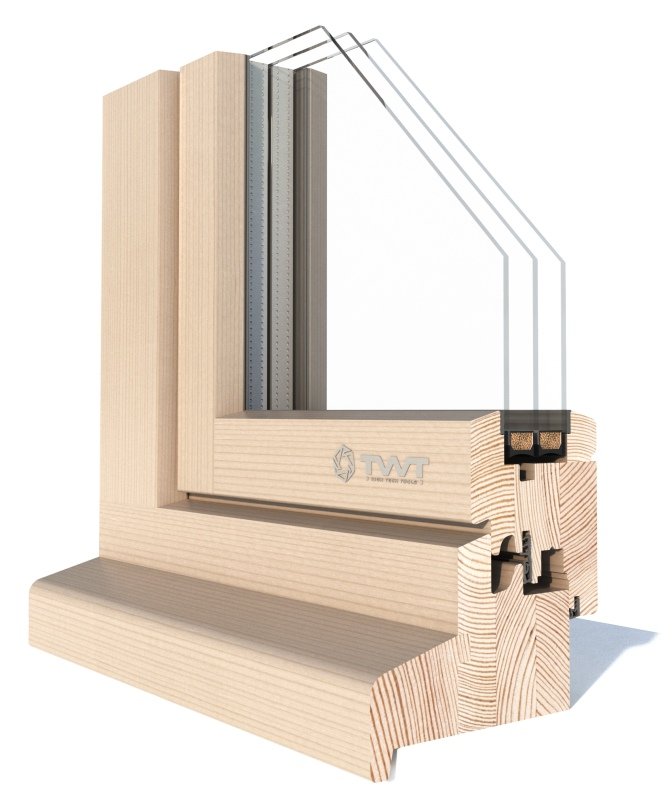

I would say the Esperia Life window. This product brings together in a wood and aluminium solution the objectives we have set for ourselves. The last machine we set up in France will produce this model in addition to the traditional windows.Another nice new model is the Esperia Innova window (image on the left) that – I don’t know how to put it – is a window without compromise! It was designed for the Italian market and then the company intuited its potential for becoming an international prospect. In 2021 it will be big news abroad!

Due to the Covid-19 pandemic, I guess fairs have been cancelled, so how are you presenting these new products?

Yes, a few fairs have been cancelled. But anyway, in Belgium the Prowood is held every three years and its next edition will bein October 2021; in France and Lyonthe Eurobois is scheduled for 2022;in The Netherlands there is also a small fair called HoutPro+,also scheduled for 2022. We shall see how the situation evolves!

In the meantime, in these months we have strived to improve the multimedia communication proposal and to allow clients to acquaint themselves with the new solutions via interactive brochures and via presentations and consultancy by video calls. We are working in this direction.

The order that has given you the most satisfaction?

Given that all of the orders are a source of satisfaction, a particularly satisfying job was that done with Norma Chassis in Belgium, a fairly important company that was already our client:they had us renew their entire machine tool pool.

In your opinion, which added value can TWT provide?

The strengths are its consulting, technical support and pre- and post-sale services. I believe that a differentiating element of TWT’s image is the fact that it stems from the merging of two companies that already had a profound historic background with great experience in the industry. TWT is a young company with the aim of innovation stemming from consolidated experience. I think this is an important and significant aspect for potential clients.

Future objectives?

Personally, I intend to develop the presence of TWT in northern Netherlands. This is a professional objective I would be very happy to fulfil. As for TWT, the corporate objectives are to consolidate the trusted business relationships that we have been enjoying for years in order to strengthen our and their market.